Hypercall: Building the Options Layer on Hyperliquid

In TradFi, options dominate flows, regularly exceeding U.S. cash equity trading. By building an on-chain Deribit, we can finally unlock the biggest opportunity in crypto: on-chain options.

The Biggest Opportunity in All of Crypto

We are building the world’s largest options venue. On Hyperliquid.

Options trading is now mainstream for retail, unlocking a massive opportunity to meet this demand on-chain. Hyperliquid’s liquidity, evolving retail trading behavior, and poor TradFi alternatives create a unique opportunity to bring options on-chain.

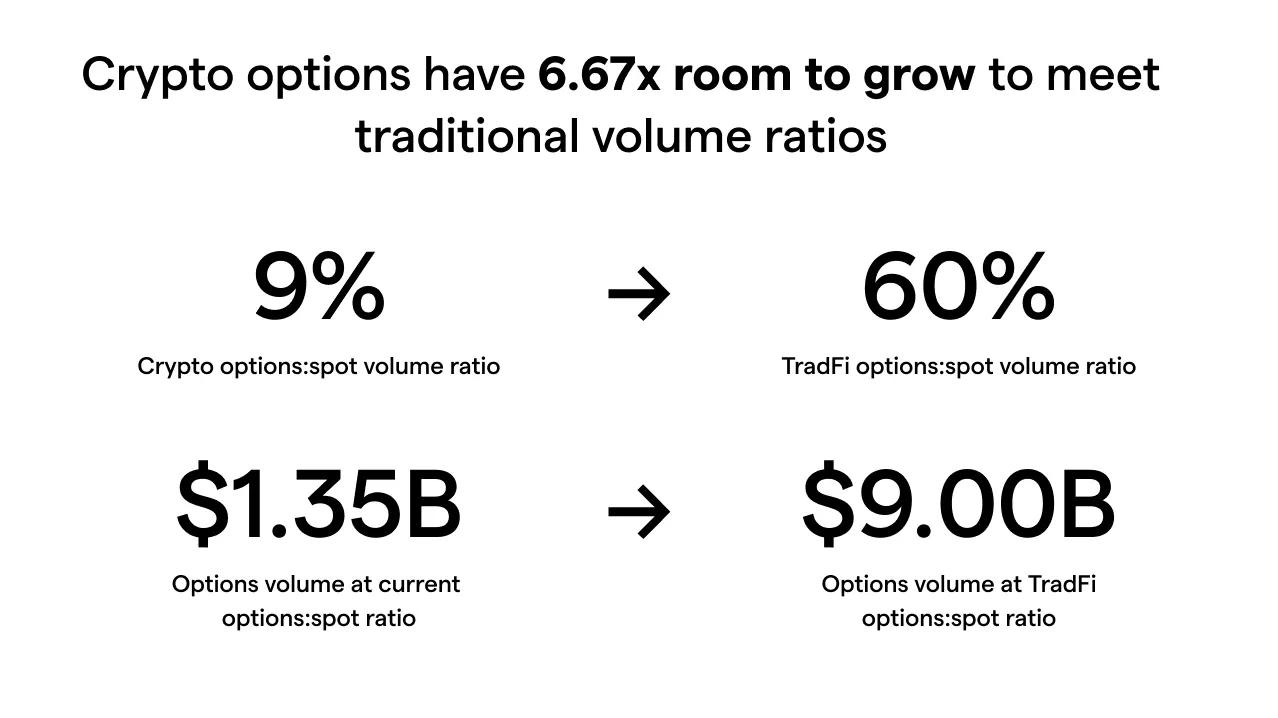

In TradFi, options dominate flows: SPX options alone trade about $2.4–$2.5T of notional per day, now regularly exceeding U.S. cash equity trading. In crypto, options are still ≲10% of spot, mostly because on-venue hedging was too costly to offer on-chain options.

By building an on-chain Deribit, we can finally unlock the biggest opportunity in crypto: on-chain options.

Options trading is now mainstream

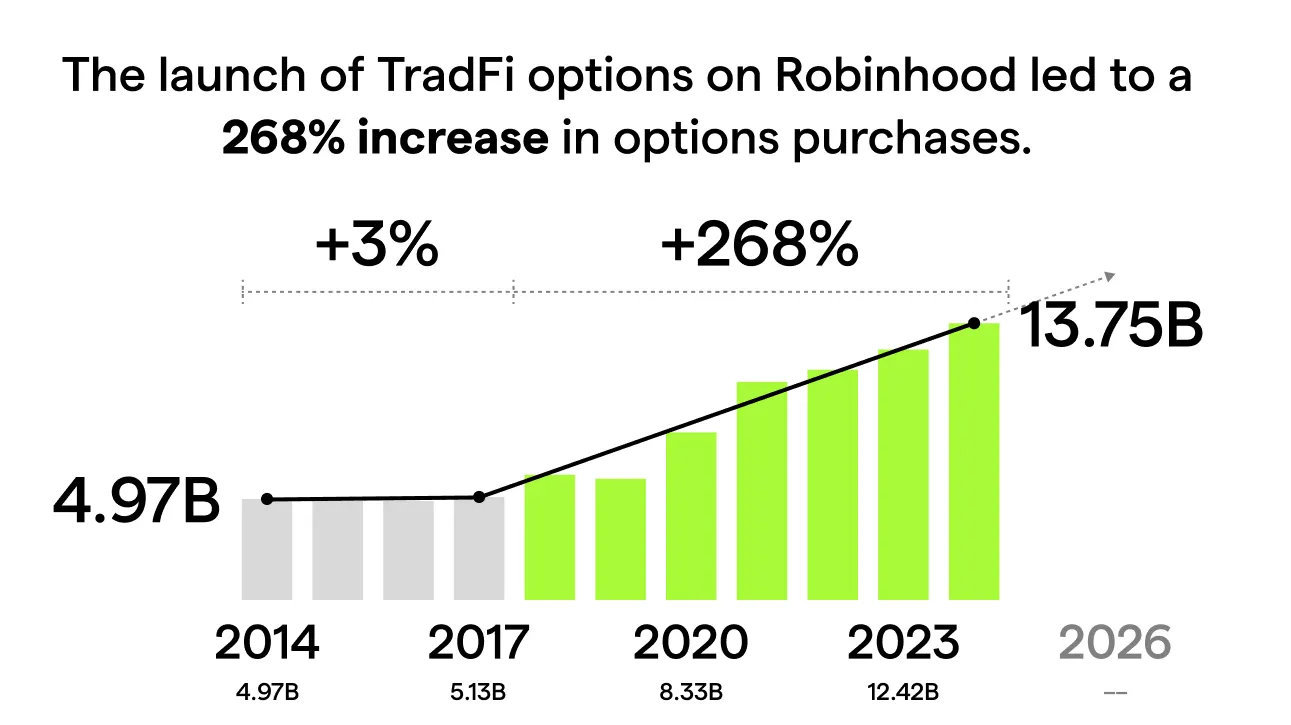

Options have not always been such a dominant instrument. Over the past 10 years, they have exhibited explosive growth among every class of trader. When Robinhood launched, it changed everything. Since then, options trading has grown 15% year over year.

This explosion in growth is important for one reason. It shows retail traders desire, and love options products.

Options particularly appeal to retail traders today for three main reasons.

- Options are the best way to get leverage — Options have formed the backbone of equities trading for over a decade for one simple reason: they work.

- If you think $BTC is going up 5% the next day, you can express that opinion with no blow-up risk and a payoff that’s a multiple of what you’d get from going even 10x levered long.

- Non-Crypto Natives are already comfortable with Options: Over the past decade options have gone from a niche derivative to the primary way retail traders express their opinion on the market.

- We saw this with $GME and continue to see it with names like $TSLA and $NVDA. If someone is new to crypto and they want to go long, they’ll reach for Options before Perps.

- No Liquidations: Unlike perpetual futures where liquidations in portfolio margin can cause you to lose your portfolio (even at leverage ratios that feel “safe”), options have a capped loss. This means that you can have your lunch and eat it too: Leverage without blowing up.

All this explains why Options are incredibly popular in TradFi.

It also explain why Options in crypto are inevitable.

User-Familiarity Matters

What the 2017 inflection point demonstrates is that the key to building a premier trading interface is UX. Poor UX has formed a very big barrier to option adoption among crypto natives.

Hsaka recently said:

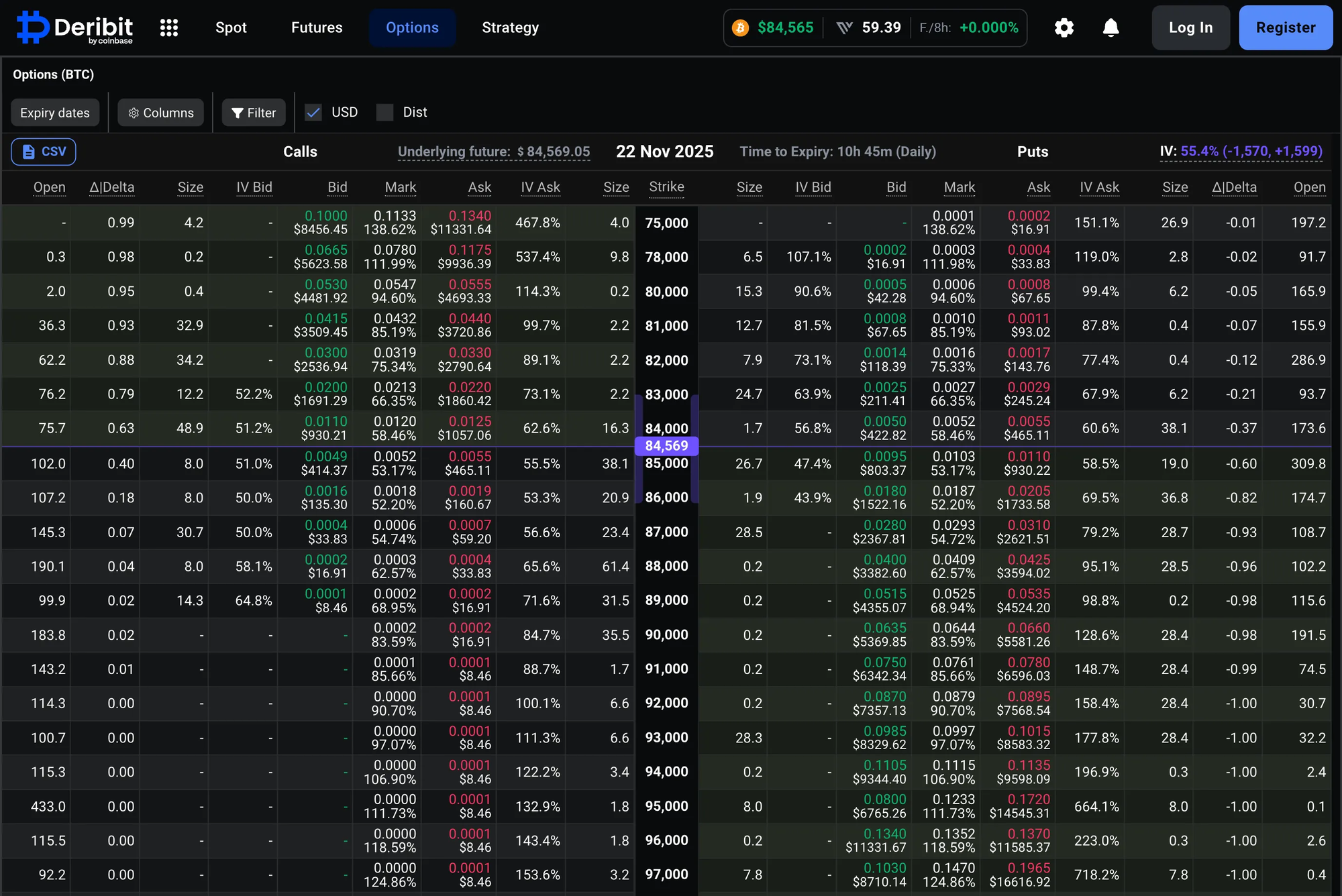

We believe that the same thing is true for Options. Robinhood solved the options UX a decade ago and yet most options trading products still look like this:

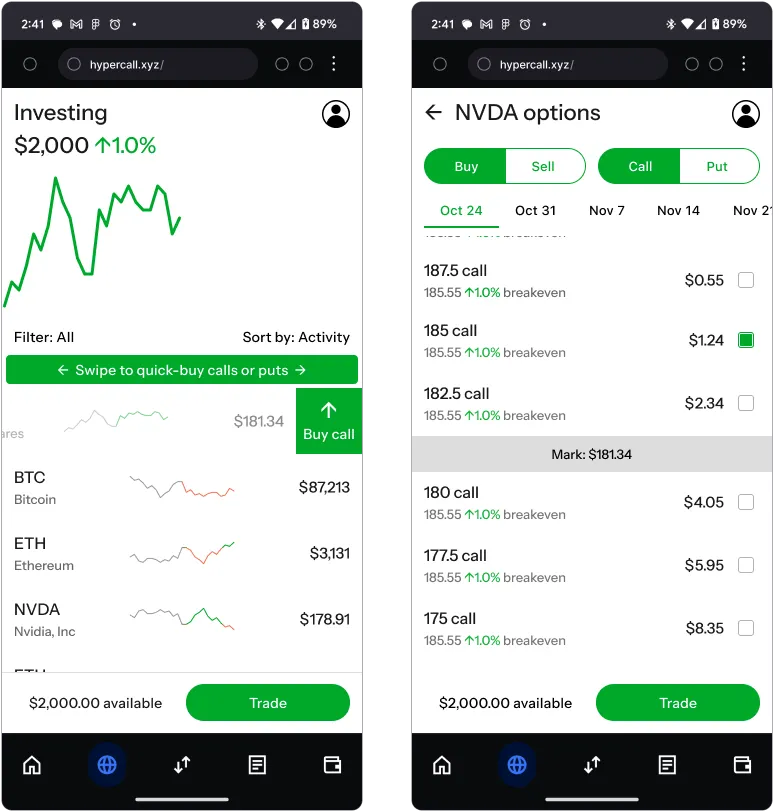

Instead of ignoring these advancements, Hypercall has built a best in class mobile trading experience that takes advantage of users muscle memory and familiarity with the interface.

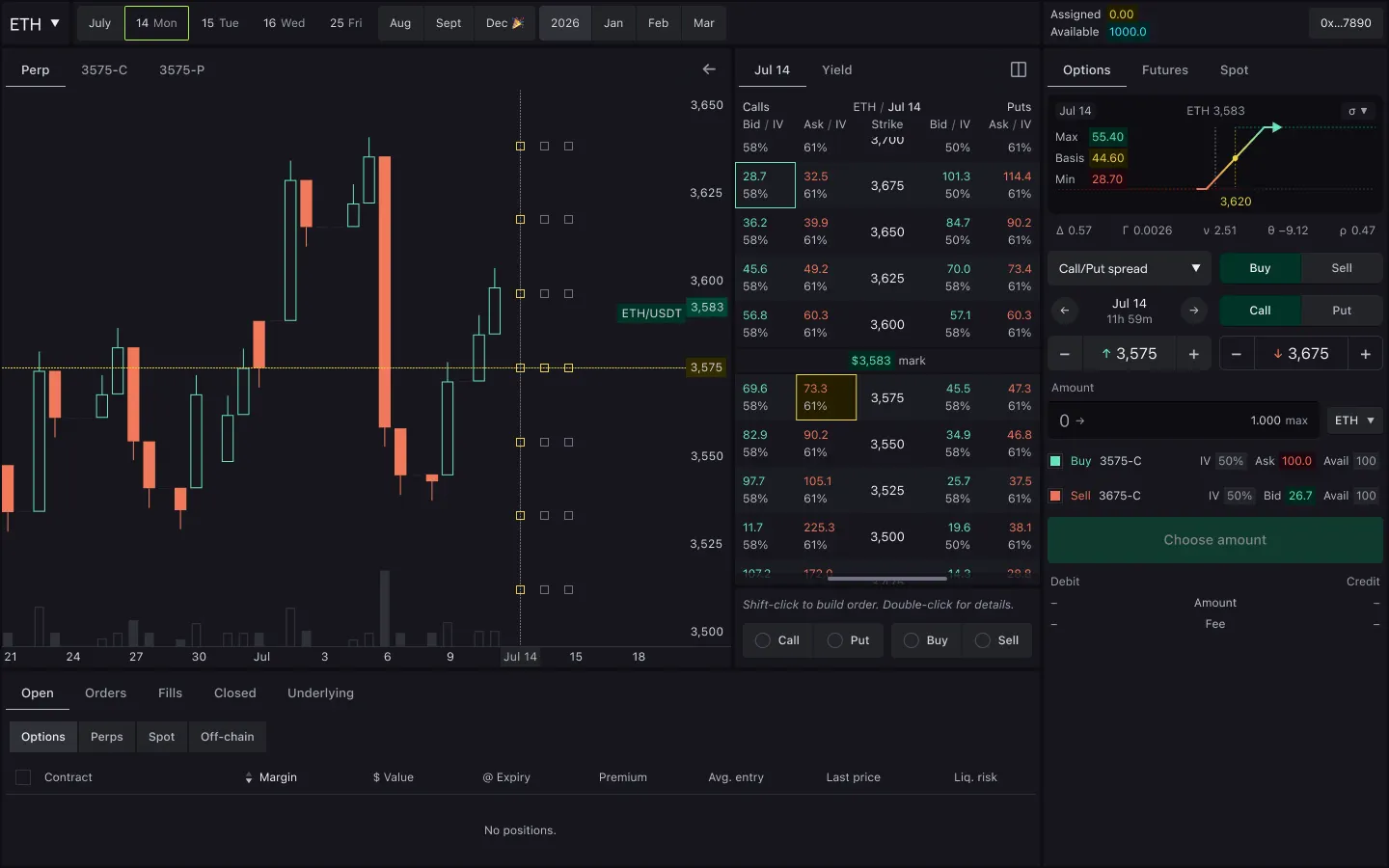

But simple doesn’t mean watered-down. While we’ve built an incredibly simple mobile experience for Options traders on mobile, on desktop we’ve designed an incredibly advanced options interface for professional traders and options writers:

Combining these allows us to attract some of the best maker & taker flows in the industry.

Team:

We currently are a small team of five with a track record of building widely used crypto applications. We previously built Synapse, a crypto protocol that processed over $60 billion in volume and supported over 3 million users. The team also boasts:

- The former lead designer at a top-3 crypto derivatives venue

- ex-HFT options-backend engineer

- 10+ years shipping production code in crypto & derivatives

In the last 3 months we built and shipped an MVP from scratch, with a target testnet launch of Q4 2025. Testnet will boast a best of industry risk engine, SPAN grid, multi-legged options with atomic execution and the ability to delta hedge via perps or spot, all on Hyperliquid.

We’re planning on launching this product as part of the Synapse Protocol family. We believe Synapse’s name recognition, brand trust and listings make it the best possible ticker to grow and support what we believe will become the pre-eminent options exchange venue.

In the meantime, if you are able to help with the following, any leads would be greatly appreciated:

- Design‑partner market makers to Stress‑test margin grid & liquidation parameters and seed two‑sided quotes on launch day (rebates + rev‑share + loan)

- Feedback on synthetic equity options market structure powered by Hyperliquid’s equity‑perps

- Growth Roles: We’re looking for a new team member to lead growth/community outreach. If you are a hyperliquid native and as excited about options as we are please reach out!

- Product Feedback: We’re obsessed with building the worlds greatest options trading venue. If you have anything to add, please let us know!

- Exchanges/Apps: Much like Hyperliquid, we’ll be implementing builder codes to share options trading revenue with frontends. If this sounds like you, please reach out!

- Engineers: If you’re passionate about options and building the future of finance, please reach out!

Please comment below or dm us on Twitter. We look forward to hearing from you!

About HyperCall

Built to be a flagship venue for traders, market makers, and integrators alike.

Hypercall is an on-chain options exchange built for real, continuous liquidity. It is designed to be a professional options trading venue: tight spreads, meaningful size, predictable execution, and reliable lifecycle rules.

Learn More

- Website: https://hypercall.xyz

- Docs: https://docs.hypercall.xyz

Disclaimer

This content is informational and not financial or investment advice. Digital asset trading carries risk.