December Update

Last month, we came out of stealth to announce Hypercall. We would like to walk you through the tangible progress we have made since then.

Tl;DR:

- Demand: 40+ trader calls, 12+ market makers, 15+ integration conversations.

- Current Priority: Getting testnet to market

- Next: public testnet early Q1; partner announcements when users can actually click through and trade.

- How to help: intros to Rust/options engineers + market makers + traders who hedge perps with options.

Last month, we came out of stealth to announce Hypercall and share what we’ve been building and why. The response has been absolutely overwhelming.

I can’t share names or specifics yet because a lot of that information is tied to partner timelines, NDAs, and basic competitive strategy. Those details will come as discrete announcements closer to testnet and launch. What I can do is quantify the demand we’ve seen and walk through tangible progress.

Here are a few numbers that capture the level of inbound:

- 40+ Options Traders got on calls with me to give feedback on the product & our approach

- 12+ Market makers reached out to figure out how to integrate Hypercall

- 15+ Other protocols/companies reached out to inquire about integrations

These calls have been incredibly energizing and helped to validate our options thesis.

What’s not in the update

Some details aren’t in this update, mostly partnerships and go-to-market. That’s deliberate.

You only get one “first announcement” per partnership, and we want that moment to be when people can actually click through, try the product, and convert. So we’ll share names when the product is live and it actually matters.

Product/Engineering

Over the past month, we’ve been very busy accelerating our product timeline to meet market demand. Some things we’ve been working on include:

- Building volatility surfaces and pricing models so our margining engine that can price assets without liquid options markets

- Portfolio margin scenario grid (how we stress-test positions under big moves)

- Streaming low latency mark prices from Hyperliquid

- Integrating Hyperliquid positions into span + margining engines and finalizing smart contract boundaries

- Expanding automated testing with a large scenario matrix plus representative strategy tests (long vol, naked shorts, risk reversals) to catch margin regressions

- Alpha testing on our mobile frontend with different wallets

- Perfecting our desktops position builder to visualize risk for different kinds of options.

Rather than go through a changelog, I want to highlight one subsystem that’s both the most difficult and decisive for whether Hypercall works: margining. If we get this right, market makers can quote tighter with less idle collateral. If we get it wrong, you either can’t list serious markets or you liquidate users unpredictably.

Margining

Margining is undoubtedly the most important and most complex part of Hypercall and something we’ve been working very hard on. First — let’s go through an example to see how it works.

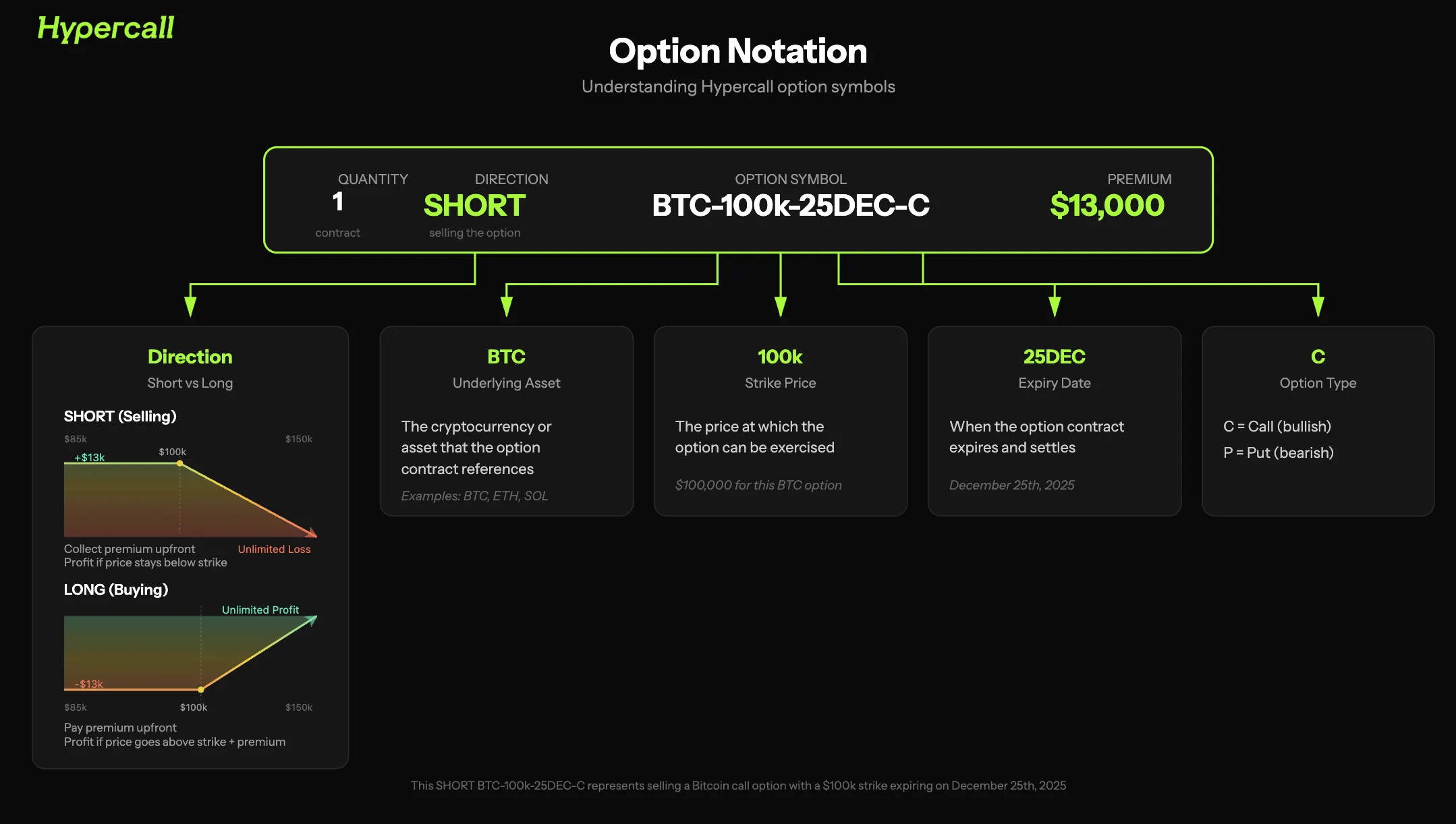

A user wants to go “short” 1 BTC-100k-DEC25-C.

They collect a $13,000 premium up front. At expiry, if BTC settles above $100k, the short call loses $1 for every $1 BTC settles above $100k (per 1 BTC contract). The premium offsets the first $13k of that loss, but beyond that the loss keeps scaling.

Protocols have traditionally dealt with this by only allowing “covered calls”. That is, you need to lock up an entire BTC until expiry in case the option ends up expiring in the money.

But 1 BTC is a lot of collateral to tie up just in case improbable move happens and it’s too expensive for liquidity providers to be profitable. What’s needed is leverage.

Margining is the risk engine. It decides how much risk we let an account take on, how much collateral it needs to hold that risk safely, and when we have to liquidate positions to keep the system solvent. With options, this matters more than almost anything else because option payoffs are nonlinear and risk can change fast as price and volatility move.

Two Types of Margining

To maximize capital efficiency, we let users choose the kind of margin they want to use. By default, all mobile users will use “standard margin”. It’s simple, and, for most long-only users something they won’t even realize exists.

Portfolio margining is our solution to options liquidity: it lets liquidity providers use all sorts of clever risk offsetting mechanisms to write more options cheaper, replicating the capital efficiency that has kept Deribit for so long.

Here’s how they work:

Standard Margin: treats positions more independently and applies straightforward requirements so it’s easy to reason about and hard to “game” by construction. It’s best for new users, smaller accounts, and anyone who wants predictability over maximum capital efficiency.

Portfolio Margin: looks at the portfolio as a whole and gives credit when positions hedge each other (think spreads, hedged shorts, or delta hedges). That makes it more capital efficient, which is what sophisticated traders and market makers need to quote tighter and run more strategies. It’s also harder to build because you have to model how many positions interact under stress, not just one position in isolation.

At a high level, margining is a liquidity feature. When margin is accurate and capital-efficient, market makers can quote deeper books with less idle collateral, spreads tighten, and more strategies become viable without turning the exchange into a liquidation machine. And unlike most venues, our margin system is designed to work with perps and spot liquidity on Hyperliquid. That’s powerful because the hedges people actually want to run (spot, perps, options together) can be supported on the same underlying liquidity, instead of forcing everything into siloed collateral buckets.

By taking advantage of Hyperliquid’s existing liquidity, we can build the holy grail of options exchanges: deep liquidity on perps and options in the same place.

Growth

We’ve been working very hard on different growth strategies, even in advance of putting out our product. We’ve pioneered an unbranded social media strategy where we’ve been putting out short-form videos about options across different platforms to learn what works and what doesn’t.

We’ve also brought on a new hire who’s previously worked on some of the leading options exchanges and has been leading partnerships for us. The fruits of these efforts will be announced at the highest point of leverage: when we’ve got a live product for people to play with.

Takeaways

We’ve made an immense amount of progress over the past month. It’s been inspiring to watch the team ship feature after feature and grind out documentation, marketing content and work with some of the best people in the space to bring Hypercall to life.

The product we’re building is one of the most ambitious ever attempted. It spans desktop, mobile and takes advantage of Hyperliquid’s liquidity in a way few have dared to.

We think it’s going to be a game changer and we’re looking forward to sharing testnet and docs as soon as they’re ready.

What’s Next

We’re planning to ship a public testnet as early in Q1 as possible. Testnet has become a bit of a meme in crypto, an utterly pointless step between development and mainnet that’s treated as a non-event.

This is not true for options exchanges. Options are extremely hard to market make for. Integrating trading systems into options margin is a non-trivial exercise and so, for our liquidity partners, it’s extremely important to have sufficient time to integrate and quote on testnet prior to mainnet.

Testnets are also important to us for the same reasons they’re important to L1 teams: to spot bugs that could lead to critical errors or loss of funds post-deployment.

Testnet therefore marks the next crucial step forward for Hypercall and SYN holders.

How you can help

While we’ve had lots of good calls with market makers, traders and exchanges what we still need is experienced backend engineers.

If you know someone who is:

- Options Native — Has worked on/traded options heavily in the past and has a deep level of fluency with crypto or tradfi margining systems.

- Rust Fluent — Someone who is comfortable with Rust or another correctness oriented low-level language

- Passionate — About building the worlds largest options exchange on top of the house of all finance

Please reach out on telegram or X. We’d love to chat!

Additionally, if you’re someone that currently trades perps, but has specific needs around hedging with options, we’d love your feedback!

Merry Christmas!

About HyperCall

Built to be a flagship venue for traders, market makers, and integrators alike.

Hypercall is an on-chain options exchange built for real, continuous liquidity. It is designed to be a professional options trading venue: tight spreads, meaningful size, predictable execution, and reliable lifecycle rules.

Learn More

- Website: https://hypercall.xyz

- Docs: https://docs.hypercall.xyz

Disclaimer

This content is informational and not financial or investment advice. Digital asset trading carries risk.